The USD is telling you to take that European holiday, but your portfolio (and the burning tarmacs) are telling you NO - what to do?

For the first time in nearly two decades, the Euro and the USD are exchanging at a 1-to-1 rate.. is it finally time for that European excursion that you’ve been putting off?

Sunday, July 24th, 2022

Before we jump into things, welcome back to the weekend edition of the Goldiggers Newsletter, where we dig for the golden stories in today’s market.

Today, we’ll be looking at the turbulence of this past week where we saw tech stocks crash at week’s end, which cut into weekly gains for all three major averages (Dow, S&P 500, Nasdaq). This caused the dollar to experience its first “major” slip all month, allowing gold to move out of the “danger zone” into a safer but not risk-free $1727.44.

Here’s how the major indicators are stacking up year-to-date:

Silver: -20.83%

Gold: -5.75%

Dow Jones Industrial Average: -12.22%

S&P 500: -16.88%

Nasdaq Composite: -24.36%

Oil: 26.03%

Bitcoin (BTC-USD): -51.3%

Ether (ETH-USD): -58.51%

Wrapping up the week with:

Tech - $130 Billion worth of tech stocks gone in a Snap (Inc.)…

Economy - The US Dollar is stronger than many believed possible… How's this happening?

Precious Metals - Gold dipped into the “danger zone” but closed out the week with a promising push

Commodities - Russia raises oil output for the third month in a row

Crypto - Bitcoin investors are afforded a very small breath of relief after 73 day “extreme fear” period breaks

Tech

One bad apple really can spoil the whole bunch, and we saw that happen Friday with the release of Snap Inc.’s second quarter earnings report. The social media company disclosed a wider-than-expected loss, causing the stock to immediately drop 39% as it fell to its lowest level in two years.

Wall Street was expecting to see a loss, but was not expecting the social media behemoth, which caters to 347 million active users per day, to report such dismal earnings. These poor earnings are a result of cut advertising dollars as companies have drastically reduced ad spend with the economic pressure on consumers to stop spending. TikTok’s strong engagement power resulting in industry domination is also a factor in Snap’s poor market performance.

This led to a domino effect of other social media stocks dropping, wiping nearly $130 billion off the market values of tech stocks on Friday.

Snap’s shares have dropped 80% this year, Meta and Pinterest are experiencing similar slowing pains with shares dropping 50%.

Economy

While the market share of social media stocks is performing worse than expected, the same cannot be said for the USD. At its highest level in two-decades, many hedge funds and investment banks across the globe believe the USD still has “room to run” despite having already passed the Euro just last week.

But… how? The poor state of the economy does not seem like a rich breeding ground for a strong USD…

We can credit the “success” of the USD in part to the Fed’s fast rate hike in an attempt to tame inflation. This attracted more investors to the dollar in comparison to other global currencies. Also - many investors see the dollar as a safe haven for their money during this period of market uncertainty, and are choosing to withdraw their investments while they wait for smoother waters.

So though your portfolio might be down, the surging dollar is making that European vacation look like a steal of a deal… and if you have the capital, it might not hurt to pick up a European investment property while you’re down there (some advisors have been suggesting).

Precious Metals

Things were looking pretty scary for gold investors last week when we saw gold close out a stone's throw away from the “danger zone” at $1706. This week, thanks to a slight dip in the dollar as a result of the poor performance of tech stocks, gold is experiencing some relief.

The precious metal closed out on Friday at $1727.44, a figure that’s giving investors room to breath after a five-week losing streak which saw gold plummet to a one-year low of $1680.25 on Thursday.

An inverse relationship is at play between gold and the USD, with one's success signalling the other's failure. Though the USD is outperforming gold at current, a looming recession may tip the scales back in favor of gold as it’s known to be the investment of choice when times are tough.

Commodities

Russia continues to increase its oil production - but who’s buying it??

Well… China and India are, and the sale of this oil has created healthy profits of $9.5 billion to fund the Kremlin’s attack against the Ukraine.

For Moscow to experience an economic pinch that would impact their war path, the global demand of oil would need to fall, which we all know is something that is very unlikely to happen anytime soon.

Crypto

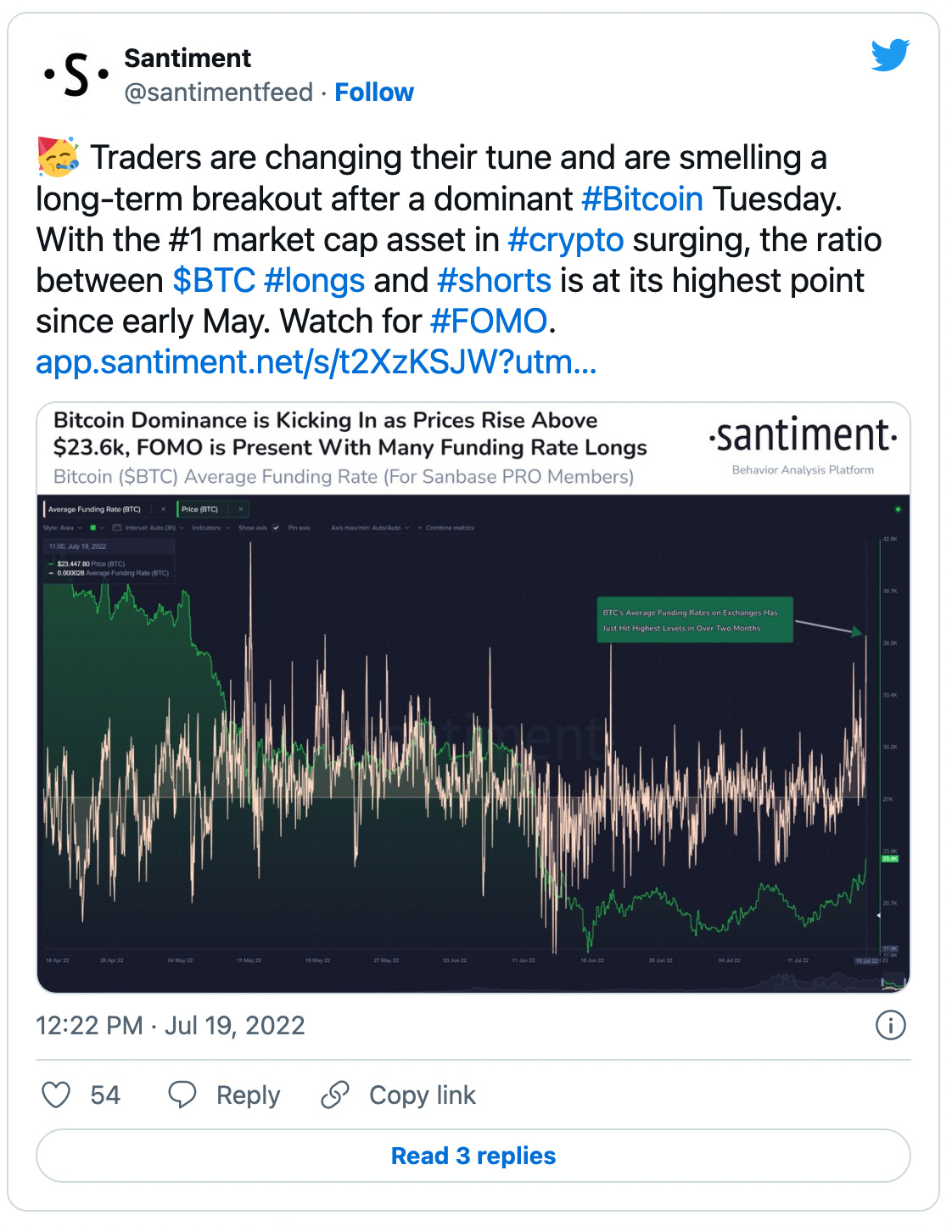

It was a longggg 73 days for Bitcoin investors who have been in a state of “extreme fear” all the while.

But alas, this past Tuesday, the Bitcoin community was afforded a small amount of respite with the scales tipping from “extreme fear” to “fearful”.

Committed investors are looking at the long game when it comes to Bitcoin, with many still believing the cryptocurrency has the potential to surpass $500,000 in the next five years.

Source: @Santiment

Key Takeaways From The Week:

Tech - Social media stocks are feeling the pinch of cut ad spend, which resulted in a wipeout of $130 billion in market value on Friday

Economy - The USD is continuing to rally in comparison to other currencies, but the sustainability of this is coming into question as a recession looms

Precious Metals - A dip in the dollar allowed gold to squeak back into the safe (well… safe-ish zone) - in the short term it may dip back down again but in the long term, it may be a safe haven for your investments if a recession strikes

Commodities - Russian oil sales are fuelling their fight in Ukraine, and China is a major supporter

Crypto - It’s the long game for Bitcoin investors - but the payoff could be huge

That’s all for this week’s updates. If you enjoyed what we dug up for you, register for our newsletter through the subscribe button below and we’ll continue to drop golden nuggets of market info into your inbox.

The opinions shared in this newsletter are not intended to serve as investment advice, and are not to be used as the basis for any financial decisions, these are the opinions of the individuals mentioned in this newsletter as covered by the creators of the newsletter.

We cannot guarantee the accuracy of all the information shared above and advise you to do further research if you intend to use any of the above information in your financial decisions.