Why is the USD at its Highest Point in Over 20 Years? Who's to Blame?

Grass grows where you water it… unless that grass is the US dollar - which can apparently grow in a dumpster fire.

May 11th, 2022

Welcome to this week’s Goldiggers Newsletter, where we dig for the golden stories that are impacting today’s markets.

Now pick up your coffees while we pick up our shovels, and let’s dive right into this week’s dirt.

Here’s what’s happening right now:

Precious metals are down.

GDP is down.

Inflation is at its highest point in 40 years.

The American dollar is… UP? And it’s at a 20 year high??

Source: Wall Street Silver

“I see what’s happening in trading and it doesn’t make any sense,” shared mining tycoon Frank Guistra in response to the current state of the American dollar.

Frank’s theory: gold is being manipulated by the Fed

“I think [the Fed] is working with bullion banks and I think that they don’t necessarily communicate directly with the bullion banks,” Guistra proposed, believing that the Fed is communicating through the BIS (Bank of International Settlements) in instructing them to sell futures, which is then executed through the bullion banks.

Will there ever be a smoking gun to prove Guistra’s suspicions?

Probably not. In situations like this, there is rarely definitive proof, only circumstantial evidence.

But many seasoned investors in the mining space are watching the writing form on the wall, and are of the same belief given that the current state of the American economy simply doesn’t make sense.

However, not all investors share the same suspicions…

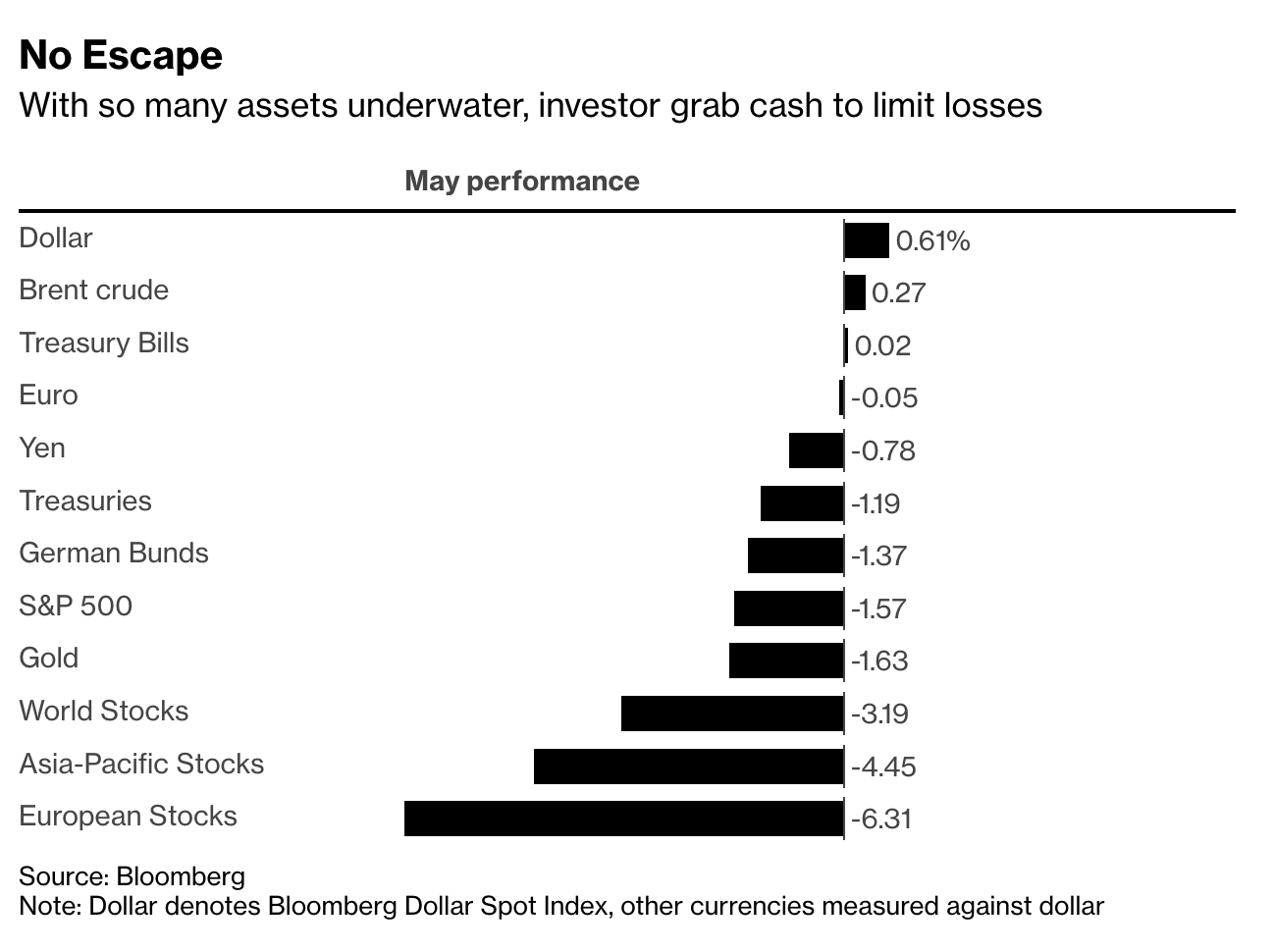

Is the rise of the dollar really such a shock when we take into account the mad dash that many investors are making to get their hands on cash?

Bloomberg doesn’t think so.

In a recent article, the business and markets news publication shared, “Cash Is the Only Winner in a Market Gripped by Stagflation Fear.”

We’ve seen stocks and bonds sliding all year, with an even sharper dip since the Fed’s 50-basis point raise last week indicating wide-spread sell offs.

“You can’t think of a worse environment than where we are right now for financial assets,” shared Tudor Investment Corp’s CEO, Paul Tudor. “Clearly you don’t want to own bonds and stocks.”

Even commodity loyalists are starting to lighten their loads at the beginning of this week due to fears over this toxic investment landscape.

This market wide fear-driven unloading of stocks and bonds in exchange for cold, hard cash makes the natural rise of the American dollar (despite the state of the current economy) quite plausible.

Let’s flip this question over to the audience - what do you think? Is gold being manipulated to drive up the US dollar? Or is it organically occurring as a result of stagflation fear? Weigh in with your opinion through this anonymous poll.

Word on the Web

We’ve asked a few industry experts to weigh in on what’s going on, and here’s what they’re saying:

Todd “Bubba” Horwitz predicts that the market is in for a 40 to 60 percent haircut in the equity market, and that the Fed is clueless about what’s going on.

One way to protect your money during this time? Precious metals!

“If you want to really have the true representation of precious metals,” shared Bubba, “you have to buy the physical product. If it goes to $1600 you have to not panic, you have to buy it with dollars you don’t need and put it in your safe or put it in your drawer.”

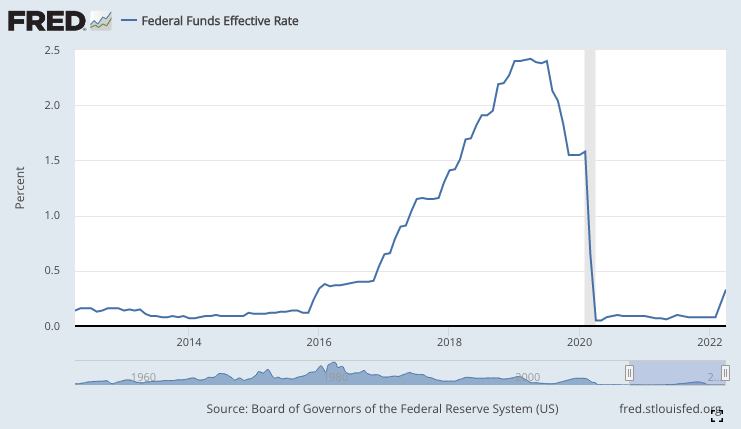

Economic Ninja confirmed that we’re “seeing absolute chaos in the markets right now,” and that investors can expect to see the Fed stop raising rates by mid-June, which is all part of the “Raise - Hold - Lower” tactic that we saw at the end of 2018, and that we’ll see again this year.

Source: FRED

Michael Oliver, CEO of Momentum Structural Analysis, predicts that, “Gold will benefit from the natural gas rise, not because it predicts commodity inflation… but gold’s anticipating the next event and if you get a global economic downturn with natural gas being the time bomb that helps kick it into gear, gold’s going to benefit vastly from that.”

Tuck those golden nuggets of info in your pocket and save them for a rainy day (or…. now… since it’s kind of a monsoon in the market right now).

Let’s close things up with a recap:

The USD is at a 20 year high

Inflation is at it’s highest point in 40 years

GDP is down

Gold is down

Commodities have started dropping

Stagflation is creating fear selling

Cash is king

Interest rates are expected to rise, hold, and then lower - perhaps sooner than you think

Get your hands on some gold (if you can)

Want to continue collecting these golden nuggets of market info? Sign up for our weekly newsletter today!

That’s it for today, stay golden!

The opinions shared in this newsletters are not intended to serve as investment advice, and are not to be used as the basis for any sound investment, these are the opinions of the individuals mentioned in this newsletter.

USDX fantasy?